Hydrogen’s Future Role in Mobility

May 2021

The electrification of mobility is gaining momentum at a fast pace. Sales of plug-in vehicles shot up by about 40% in 2020 to over 3 millions units, over half being fully electric. Despite this increase, it represents only 4% of total light vehicle sales — see my recent article. This year is off to significant start again in Europe and China whereas the USA market is expected to get back into growth mode thanks to a widening product range and ambitious federal initiatives.

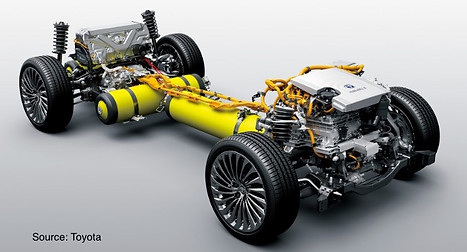

A vast majority of investments aimed at electrifying fleets is currently going to plug-in hybrid and even more so to battery electric vehicles (BEV). Nevertheless, the future of clean mobility also includes Fuel Cell EVs (FCEVs), i.e. a hydrogen (H2) fuel cells combined with a high pressure H2 tank and a battery pack to power the e-motor(s). The deployment of this alternative path will vary by application depending on how the two energy storage modes best benefit specific applications.

Fuel Cells vs. Full Battery and their Applications

There are inherent benefits to both solutions. They relate to energy density (thus weight for a given range), overall well-to-wheel efficiency, system volume including on-board energy storage, availability of the charging infrastructure, fueling time, and of course system and energy costs.

Well-to-wheel efficiency is significantly higher with BEVs than FCEVs, i.e. about 75% vs. 25-30% (sources: 1, 2). This gap stems from the high number of inefficient steps for the latter, especially producing H2, compressing and transporting it to the fueling station, and converting it into electricity in the FC.

Operating costs are currently much higher for FCEVs than BEVs with energy costing $2-3/100 km (15-20 kWh/100 km) for the former vs. ≈$12-15 for the latter (1 kg H2/100km) for a light vehicle. However, we can expect this gap to shrink in the coming years as H2 production and distribution supply chains improve. We can also expect a gap in maintenance cost as it is virtually null for BEVs.

Hydrogen offers a much higher energy density than current batteries at about ≈35 kWh/kg vs. ≈200 Wh/kg. This gap is expected to drop yet to remain very significant as the latter density is improving at a rate of about 7% per annum and there will be step changes.

Hydrogen’s high energy density means incremental range results in a marginal weight gain. Increasing a light FCEV’s range from 500 to 700 km can be achieved by adding less than 20 kg (incl. 2 kg of H2) on a vehicle such as the Toyota Mirai — tanks weigh 87 kg. By comparison, the equivalent range increase would translate in an extra 150-180 kg of batteries for an equivalent BEV.

The marginal impact on system cost of the same 200 km increment will also be a lot smaller for the FCEV than the equivalent BEV at about $1,200 for the higher H2 tank capacity vs. $4,000-4,500 for the extra battery capacity — at current cost levels.

Architecture is yet another differentiator between the two approaches. Battery packs can be designed as a combination of modules fitted under a vehicle’s floor with a reasonable amount of flexibility. Conversely, H2 tanks must be cylindrical to withstand the high pressure (700 bar) which make them harder to integrate in a passenger vehicles.

For the above reasons, hydrogen makes all the more sense for large vehicles with available space combined with high range requirement and weight constraints, e.g. mid/heavy trucks or cargo vans. This is also the case for aviation (e.g. startup ZeroAvia), rail (Alstom has launched H2-powered regional trains on select non-electrified lines in Europe) or ships.

In addition, H2 is currently mainly produced using “dirty” energy. In order to address this, significant funds are being invested in green hydrogen supply chains, i.e. using renewable power. Clean transportation to fueling stations must also be solved. Last, regardless of its generation process, H2 will never offer the ubiquity of electricity which enables BEVs to be charged easily at home or at the office.

The Fuel Cell and Hydrogen Ecosystem

In order for hydrogen to play a significant role in mobility, a complete ecosystem must fire on all its cylinders. It includes H2 generation, transportation and storage, fueling stations, fuel cell and H2 tank supply, OEMs and a trained service network.

A number of companies have emerged to address the H2 supply chain to the fueling point, such as McPhy (electrolysis), Hydrogenious (logistics) or Kubagen (storage).

Given their current budgetary focus on electrifying vehicles with more mature xEV technologies, OEMs have been forced to reconsider their hydrogen roadmap. For instance, Daimler has given up on light vehicle applications to focus on heavy trucks and created a 50-50 JV with Volvo Group to do so. Other collaborations have been established around fuel cells, such as Toyota-BMW, Toyota-Paccar, Honda-GM or Hyundai-Audi, as there is still a long road to massive deployment.

The hydrogen-based market also provides pivot opportunities for suppliers with significant dependance on internal combustion engines. For instance, Bosch, Faurecia and Plastic Omnium, leaders respectively in engine management, exhaust systems and fuel systems, are developing fuel cell and hydrogen-related businesses. All three have invested in or partnered with FC companies and the latter two have created H2 tank product lines.

Current Fuel Cell EV offering and Fueling Network

Only a handful of light vehicle OEMs currently offer FCEVs: Toyota (Mirai), Honda (Clarity) and Hyundai (Nexo). Renault has sold the small and large vans Kangoo and Master — the FC serves as an EV range extender. Mercedes presented a FC-powered GLC in 2019, but it seems the version has been retired. BMW recently announced it will introduce a limited series FCEV X5s in 2022.

These light vehicles are produced in limited quantities as they are expensive compared to the equivalent battery electric versions: the compact Nexo retails for $59k (+ tax) and the larger Mirai starts at $49k (+tax) in California. 7,500 FCEVs were sold globally in 2019, incl. 4,800 Nexos and 2,400 Mirais.

Limited quantities of FC trucks have also produced by Hyundai (above), Hino and Hyzon, some being deployed at the port of Los Angeles to move containers through the city to logistics centers. For reference, the equivalent battery electric heavy truck (Class 8) requires about 120 kWh of batteries per 100 km, i.e. 5t of energy storage for 1,000 km of range, which comes at the expense of payload.

The distribution of these FCEVs is also limited to a few markets due essentially to a major roadblock: the H2 fueling network, or lack thereof. At the end of 2020, there was a total of 553 stations in the world including 200 in Europe (half in Germany), 142 in Japan, 75 in the USA (⅔ in California), 69 in China and 60 in Korea. With the addition of just over 100 stations last year, we are still long way from having the necessary capillarity to enable real market growth.

The high cost of H2 fueling stations ($2-3 million incl. installation) combined with the rapidly increasing fleet of plug-in vehicles means that priority is given to developing the EV charging network where costs are significantly lower and utilization will be higher.

Given that fuel cells will gain the most traction in the near term with commercial fleets of mid and heavy trucks and vans, it makes sense to deploy H2 fueling stations at fleet hubs, ports, or along dense-truck traffic corridors, where they will likely have the highest utilization.

What to Expect Next?

I expect light FC vehicles to remain more experimental than high volume products for a number of years, especially as the focus is clearly on more affordable BEVs. However, the technology is gaining traction where long range is needed, weight is critical and space is available to install H2 tanks.

As a result, FC-based powertrains will become mostly pervasive among mid and heavy trucks, buses — and to a lesser extend large vans — designed for long distances. Nevertheless, limited volumes associated with these segments mean unit cost reduction will be slow.

Incumbent OEMs and startups are developing such large vehicles. They include Daimler, Volvo Group, Toyota’s subsidiary Hino, Hyundai’s truck unit (started shipping its Xcient FC trucks in Switzerland last year), or Paccar. In addition, Hyzon already has 400 FC trucks on the road (below) and intends to ship 5,000 FC trucks and buses by 2023. Nikola has presented several FC trucks — though their ability to deliver has been challenged. Both Hyzon and Nikola have announced plans to deploy H2 fueling stations. Likewise, several bus / coach manufacturer such as VDL have started shipping FC vehicles.

The Takeways

The current acceleration of BEV sales combined with the maturity gap with FCEVs has put a damper on FC development for light vehicles. However, hydrogen-based powertrains will definitely have their role to play in the mix, with initial deployment in fleets of commercial vehicles. This must be accompanied with the critical development of a matching fueling infrastructure.

Light vehicle OEMs would be wise to maintain FCEV-related R&D activities along with limited-volume models — as are Toyota, Hyundai, Honda, Renault, Stellantis, Great Wall or BMW — in order to eventually expand their EV offering to address the complete range of use cases.

The deployment of fuel cells and the overall H2 economy will likely be the most significant and broadest in Asia (Japan, Korea and China) and Europe. The European Commission has defined a hydrogen strategy for the region, earmarked significant budgets, and established European Clean Hydrogen Alliance, akin the European battery Alliance, aimed at spearheading a H2 economy. Likewise, China wants 1 million fuel cell vehicles on the road within a decade with a focus on long-distance logistics. As it is the case for the deployment of BEVs, the USA risks lagging when it comes to future H2-powered transportation.

Marc Amblard

Managing Director, Orsay Consulting

Feel free to comment or like this article on LinkedIn. Thanks!